Bootstrapping Zero Coupon

This is an iterative process that. As a reminder the zero-coupon rate is the yield of an instrument that does not generate any cash flows between its date of issuance and its date of maturity.

Estimating The Zero Coupon Rate Or Zero Rates Using The Bootstrap Approach And With Excel Linest Youtube

A zero curve consists of the yields to maturity for a portfolio of theoretical zero-coupon bonds that are derived from the input Bonds portfolio.

. ZeroRatesCurveDates zbtyield BondsYieldsSettle uses the bootstrap method to return a zero curve given a portfolio of coupon bonds and their yields. Get the best deal with our latest coupon codes. Bootstrapping spot rates is a forward substitution method that allows investors to determine zero-coupon rates using the par yield curve.

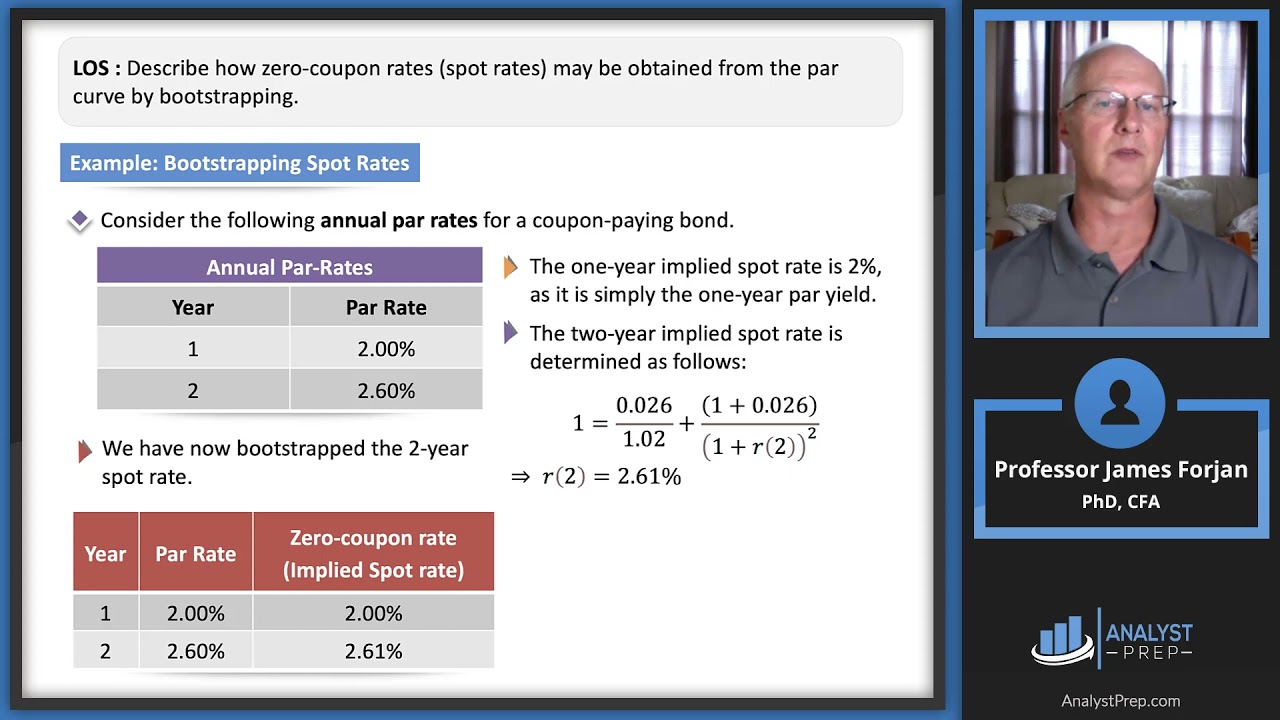

Once all the par term structure rates have been derived we us the bootstrapping method for deriving the zero curve from the par term structure. How to bootstrap zero coupon rates and what is the relationship with par yields 0 I understand the basic logic of bootstrapping zero coupon rates take a bond discount each. The bootstrap method that this function uses.

A zero curve consists of the yields to. Applying the traditional DCF-method in bond pricing works well for retail investors. Bootstrapping is a method for constructing a zero-coupon yield curve from the prices of a set of coupon-bearing productsAs you may know Treasury bills offered by the.

The technical note introduces the reader to bootstrapping. 05 year spot rate z1 4 1 year spot rate z2 43 We can now use this data to calculate the 15 year spot rate. Bootstrapping spot rates using the par curve is a very important method that allows investors to derive zero coupon interest rates from the par rate curve.

Since 15 year bond is selling at par its coupon will be 45. Bootstrapping the zero coupon yield. The slightly difficult part is to bootstrap zero rates from market swap rates for IRS.

Deposit and futures have one bullet payment at maturity but IRS has in-between cash flows. Bootstrapping produces a no-arbitrage zero coupon yield curve. More sophisticated investors such as arbitrageurs.

The par curve shows the yields to. This means that the discount factors derived from bootstrapping can be applied to arrive back at the market. Ad Find the best Discounts coupon promo codes and deals for 2022.

Bootstrapping Spot Rates Cfa Frm And Actuarial Exams Study Notes

Bootstrapping How To Construct A Zero Coupon Yield Curve In Excel

What Is Bootstrapping Learn The Cfa Level I Concept

Bootstrapping How To Construct A Zero Coupon Yield Curve In Excel

0 Response to "Bootstrapping Zero Coupon"

Post a Comment